Booms and Busts

The End of Artificial Employment

AI is not the killer—it is the coroner.

Challenging the Efficient Market Hypothesis and Fundamentals Analysis

Mainstream economics and finance theories hold that markets immediately adjust to new information. While market prices do reflect available information, the Efficient Market Hypothesis (EMH) fails to explain the boom-bust cycle as well as Austrian analysis.

Debt, Inflation, and the Illusion of Protection

The boom-and-bust cycle isn’t limited just to so-called advanced economies. It also has become a way of life in the economies of tropical countries and other emerging economies.

In Support of the Austrian Business Cycle Theory

Critics of the Austrian Business Cycle Theory claim that capital investors over time will no longer be fooled by artificially-low interest rates triggered by central banks. However, when central banks push easy money policies, the inflation itself sets the ABCT pattern in motion.

The Panic of 1857: An Austrian View

Economic historians usually are mistaken when looking at the causes of the Panic of 1857. Douglas E. French sets the record straight.

Dr. Mark Thornton Warns “Fiat Is in the ICU” and Central Banks Do Not Trust Each Other

Dr. Mark Thornton breaks down why central banks are fleeing Treasuries for physical gold and what the "Skyscraper Curse" signals for a 2026 crash.

Revenge of the Skyscraper Curse

With a record-height tower and a flooded credit system: 2026 may be when the curse returns.

Cheap Credit Doesn’t Create Economic Growth—It Makes Us Poorer

Net present value (NPV) is a popular decision-making criteria used by firms to make key, crucial choices about how to allocate resources across an economy, but this can be misleading especially when interest rates are manipulated via inflation.

Cutting Interest Rates Isn’t a Cure‑All for the Economy

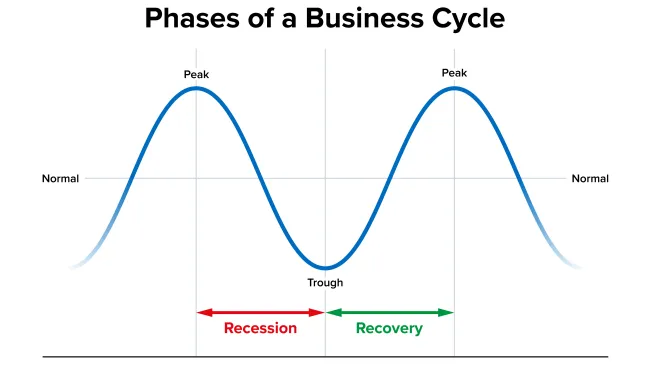

The Fed is cutting its discount rate again, but Americans will be disappointed with the results, as the Fed’s latest action only contributes to the boom-and-bust cycle.